Nevada AG Race Expands; Texas AG Contest Adds Democratic Candidate

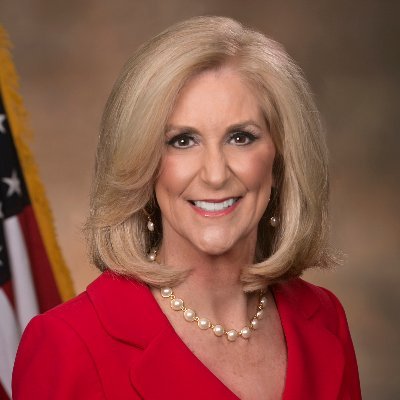

Nicole Cannizzaro, Nevada’s state senate majority leader and a former prosecutor, has announced that she is running for Nevada AG...

The news stories featured in The State AG Report are curated and summarized from publicly available media and do not reflect the opinions of Cozen O’Connor or its attorneys.

Nicole Cannizzaro, Nevada’s state senate majority leader and a former prosecutor, has announced that she is running for Nevada AG...

14 Democratic AGs and the Corporation Counsel for the City of New York submitted 16 comment letters to the U.S....

![]() No Election

No Election

![]() Open Seat*

Open Seat*

Prior to his election as attorney general of Ohio in 2018, AG Yost had a long career in public service. He served as Delaware County Auditor from 1999-2003 and County Prosecutor from 2003-2011.